How to Build Wealth as a Woman—Even If You’re a Caregiver

Smart Financial Strategies to Grow Your Money, Secure Your Future, and Overcome the Caregiving Wealth Gap

What if I told you there’s an invisible tax that drains 30% of women’s wealth, forces many to retire into financial insecurity, and is so ingrained in our culture that we hardly question it?

Welcome to this week’s issue of Femmehealth Ventures Publication—your trusted source for insightful analysis of femtech innovations through an investor's lens, helping you identify the latest opportunities in women's health technology.

If this email was forwarded to you, you have awesome friends—click below to join. Don’t forget, you can always explore our archives to catch up on any past stories.

The Hidden Tax on Women’s Wealth

It’s not the wage gap.

It’s not the pink tax.

It’s caregiving—an unpaid, undervalued, and unprotected form of labour that disproportionately falls on women.

Every day, millions of women step away from their careers, decline promotions, or work reduced hours to care for children, ageing parents, and family members in need.

They do this…

…often without financial safeguards

…often without questioning whether they should

Because it has been ingrained in them: this is what women do.

The result? Women retire with one-third less wealth than men.

A reader of my recent Substack note summed it up in four words: “Current status: spent and empty.”

This is not a personal problem. It’s a systemic failure.

Why Caregiving Is a Direct Threat to Women’s Financial Security

The economic impact of unpaid caregiving is staggering:

Women in the U.S. provide $470 billion worth of unpaid caregiving annually—yet this work is neither counted in GDP nor compensated.

The average woman loses over $300,000 in lifetime earnings due to caregiving-related career interruptions.

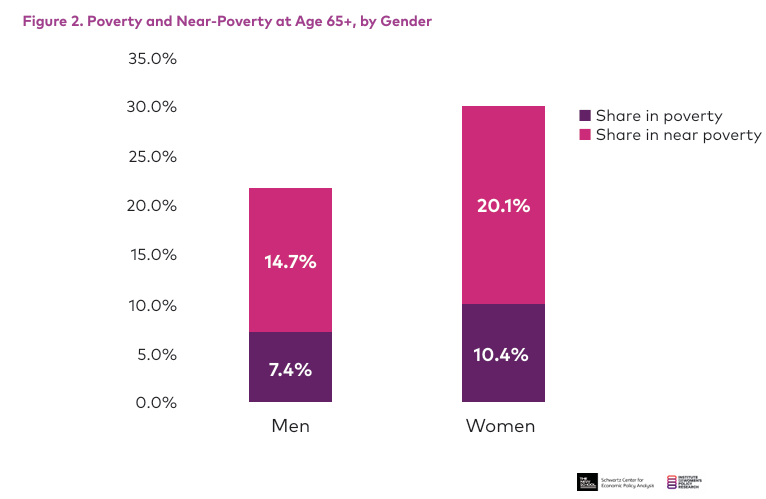

Women are 80% more likely than men to face poverty in retirement, largely due to lost earnings and lower social security benefits. Per the below chart, by age 65, 10.4% of women live in poverty, compared to 7.4% of men, and 20.1% of women live near the poverty line, compared to 14.7% of men.

Even those who remain in the workforce feel the financial strain:

43% of women have reduced their working hours to manage caregiving, compared to 28% of men.

Women aged 50+ who leave work to care for ageing parents lose an average of $324,044 in wages, benefits, and retirement savings.

In countries where pension systems are tied to lifetime earnings, caregiving-related career gaps translate into long-term financial insecurity.

And yet, despite this overwhelming evidence, caregiving is still treated as a personal responsibility, not an economic issue.

Caregivers Give Everything, but Who Cares for Them?

The financial cost is only part of the story. The mental, emotional, and physical toll is just as severe.

One reader commented, “It shows up in their bodies. The women that are everything to everyone, except themselves, develop breast cancer as a cry for help.”

This isn’t hyperbole. Studies show that unpaid carers are at higher risk of anxiety, depression, and chronic illness. The combination of financial stress and emotional burnout creates a perfect storm of health risks and economic precarity.

And here’s the cruel irony: when carers need care, they often can’t afford it.

Who Benefits? And Who Pays the Price?

The reality is this: unpaid care work subsidises the economy. If women stopped caregiving tomorrow, the cost of replacing this labour would bankrupt industries and governments.

Yet the burden is placed entirely on individual women—without safety nets, without retirement protections, and without meaningful support. A reader expressed frustration with how caregiving responsibilities are normalised:

“We raise our children. Then we raise our grandchildren. And somehow, we still end up raising everyone but ourselves.”

This is not sustainable.

The Business of Care: What If We Saw This as an Opportunity?

What if we stopped looking at caregiving as just a personal burden or a societal challenge and started seeing it as an economic opportunity?

The conversation around caregiving tends to focus on loss—lost wages, lost promotions, lost retirement security. And that’s real. But what if we flipped the lens? What if, instead of seeing caregiving as a crisis that drains resources, we saw it as a market failure waiting to be solved?

After all, the global home healthcare market is projected to reach $662.67 billion by 2027.

And…

…if caregiving is costing women $300,000+ in lost lifetime earnings

…if companies are losing productivity due to employees struggling with caregiving responsibilities, and

…if governments are bracing for the financial strain of an ageing population—shouldn’t there be more solutions designed to address these gaps?

There’s a massive unmet need, and where there is unmet need, there is opportunity.

Where Are the Market Solutions?

If we are willing to invest billions in financial planning apps, fertility startups, and mental health platforms, why is caregiving—arguably one of the biggest financial stressors in people’s lives—not a top-tier investment category?

Let’s ask the bigger questions:

💡 Why don’t more companies offer caregiving stipends or employer-sponsored eldercare?

💡 Why isn’t there more venture capital flowing into caregiving tech, when the demand is clear?

💡 Why don’t fintech startups build products that help caregivers navigate financial instability the way they do for freelancers and gig workers?

The market is there. The need is there. The numbers are there.

So, why isn’t caregiving seen as an economic sector instead of just a “personal” problem?

Why This Business Case Is So Difficult to Execute

While the caregiving economy presents an undeniable opportunity, the reality is that startups in this space face significant barriers to scaling and monetization. Here’s why:

1. Caregiving Is a "Soft Market" with Low Willingness to Pay

Most caregivers don’t see themselves as a market. They provide care out of obligation, not as a consumer decision.

Unlike childcare, where daycare costs are normalized, eldercare and family caregiving remain deeply personal and underfunded.

Many caregivers are already financially stretched, meaning even low-cost solutions may struggle with adoption.

2. The Business Model Is Unclear—Who Pays?

B2C models (caregivers paying directly) face adoption hurdles because many can’t afford to pay for solutions.

B2B models (employer-sponsored caregiving benefits) require a shift in workplace culture and long sales cycles.

B2G models (government-funded solutions) are slow-moving and highly regulated, making it difficult for startups to gain traction.

3. No Clear Buyer Persona & Low Urgency

Unlike traditional healthcare, where the patient is the buyer, caregiving responsibility is often fragmented among family members, making it hard to define who the paying customer is.

Many people don’t actively seek caregiving solutions until they are in crisis mode, which slows down consumer adoption.

4. Regulatory and Liability Challenges

Any caregiving-related business touching healthcare faces strict compliance laws (HIPAA, GDPR, state regulations).

If a startup provides caregiver-matching services, they must consider legal liability for elder abuse, fraud, and safety concerns.

5. The Scalability Problem

Caregiving services don’t scale like tech. Unlike a SaaS model, caregiving requires human labor, local regulation compliance, and cultural adaptation.

Gig-worker models (Uber-for-caregiving platforms) often face workforce retention issues, limiting their ability to grow sustainably.

What Women Can Do Now to Secure Their Long-Term Wealth

While we push for systemic change, women can’t afford to wait for policies and markets to catch up. Here’s what women can do today to protect their financial future while managing caregiving responsibilities:

1. Prioritize Your Own Financial Security—Even If It Feels Selfish

Women are conditioned to put family first, but your long-term financial health must be non-negotiable.

Instead of quitting work entirely, consider reducing hours, negotiating remote work, or seeking caregiving stipends from your employer.

2. Treat Caregiving as an Economic Decision, Not Just an Emotional One

If stepping away from work is inevitable, run the numbers first—how much will this cost in lost wages, pension contributions, and retirement savings?

Consider asking family members to contribute financially. Caregiving should not be one person’s unpaid burden.

3. Invest Early and Consistently—Even in Small Amounts

Even if you have gaps in earnings, prioritize automatic investments in retirement or pension accounts.

Use low-cost index funds or dividend stocks to create passive income streams.

4. Build Multiple Income Streams

If caregiving disrupts traditional employment, look for ways to create flexible income streams through freelancing, consulting, or passive income sources.

5. Plan for Long-Term Care—Before You Need It

Consider long-term care insurance while you are still young enough to qualify affordably.

6. Know Your Legal and Financial Rights

Make sure you are named on all financial accounts and property deeds.

Have a clear estate plan—this prevents scenarios where assets are unfairly divided.

7. Demand More from Employers and Policymakers

Advocate for caregiving-friendly policies at work.

Support policies that recognise unpaid caregiving as a factor in retirement benefits.

The Price of Care is Too High-Who Will Change That?

For too long, caregiving has been treated as an invisible force, something women just “figure out” while economies and workplaces move forward as if this labour doesn’t exist.

But the numbers don’t lie—caregiving is a financial event as much as it is an emotional one. It shapes women’s lifetime earnings, their retirement security, and their long-term health. And yet, the systems that govern wealth creation, workplace policies, and investment flows fail to reflect this reality.

If caregiving were valued the way other forms of labour are, what would the world look like?

Would women still retire with 30% less wealth?

Would career breaks still be a financial death sentence?

Would solutions still be treated as charity rather than investment opportunities?

We talk about closing wealth gaps, funding innovation, and future-proofing economies. But real progress will require reckoning with the cost of care.

So, the question is no longer whether caregiving is an issue. The question is: who will take responsibility for fixing it?

Would love to hear from those thinking about this—how do we turn caregiving from a personal burden into an economic priority?

Ways to Connect with Femmehealth Ventures

Sign-up for Femmehealth Ventures newsletter, which is published weekly on Sundays

Disclaimer

The content in this newsletter is for informational purposes only and does not constitute financial, investment, legal, or medical advice. Opinions expressed are those of the author and may not reflect the views of affiliated organisations. Readers should seek professional advice tailored to their individual circumstances before making decisions. Investing involves risk, including potential loss of principal. Past performance does not guarantee future results.

I took care of my dying mother the last six months of her life. Rather than a victim, I think of myself as the lucky one. My wealthy sister (by marriage) contributed nothing.

What a hollow life it is to reduce everything to dollars.

Such an important topic, thank you for posting! I'm hopeful that we'll see some great health tech solutions for caregiving soon but v much agree we need to work on sharing the responsibility too! It's like with reproductive health-if men had to give birth we'd probably have artificial wombs already 😂