VC Funding for Women’s Health Drops—But the Market Is Bigger Than Ever

Women’s health companies raised $1.19B in 2024, yet their share of total healthcare VC funding fell by 43%. Here’s what’s behind the decline—and why it matters for investors.

Welcome to the latest issue of the Femmehealth Ventures Publication—your trusted source for insightful analysis of femtech innovations through an investor's lens, helping you identify the latest opportunities in women's health technology.

If this email was forwarded to you, you have awesome friends—click below to join. Don’t forget, you can always explore our archives to catch up on any past stories.

Today’s Brief:

💡Is Women’s Health Funding Moving Backward?

2024 saw record attention on women’s health—but VC funding failed to keep pace.

Women’s health startups received just 2.3% of total healthcare VC funding, a 43% drop from 2023. Deals with female founders hit their lowest level since 2017.

Why is this happening, and what does it mean for investors?

Below is a breakdown of the latest funding trends—tailored for our community of (aspiring) angel investors tracking where capital is flowing and why.

📊What Is Happening?

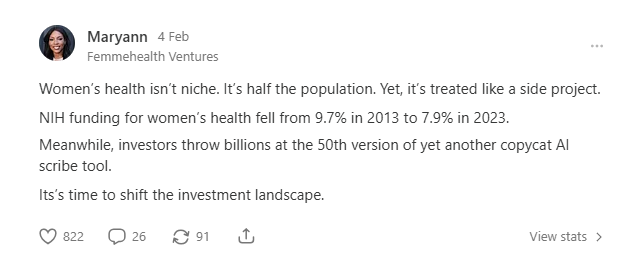

Last week, a post I wrote on the underfunding of women’s health went viral, sparking a lively and thought-provoking debate.

In the note, I highlighted that

Women’s health remains massively underfunded.

NIH funding for women’s health research, which had already declined to 7.9% in 2023 has now been cut back further with implications for research areas that were already struggling for resources.

Venture capital investment in femtech continues to slow. As a percentage of total healthcare VC funding, women’s health companies received only 2.3% of total healthcare VC funding in 2024—a 43% drop from 2023’s 4.1%, while also recording fewer funding deals in 2024. (120 in 2023 vs. 111 in 2024)

From the hundreds of responses, one thing became clear: the conversation around women’s health is growing louder.

Some highlighted the misdiagnoses and delayed treatments that result from chronic underfunding.

Others, while recognising the opportunity in women’s health, emphasised the need for a stronger investor pitch to attract more capital to the space.

❓Why Is It Happening?

1️⃣ Historical Gender Bias: Medical research has been male-centric for decades. Women were excluded from clinical trials until 1993.

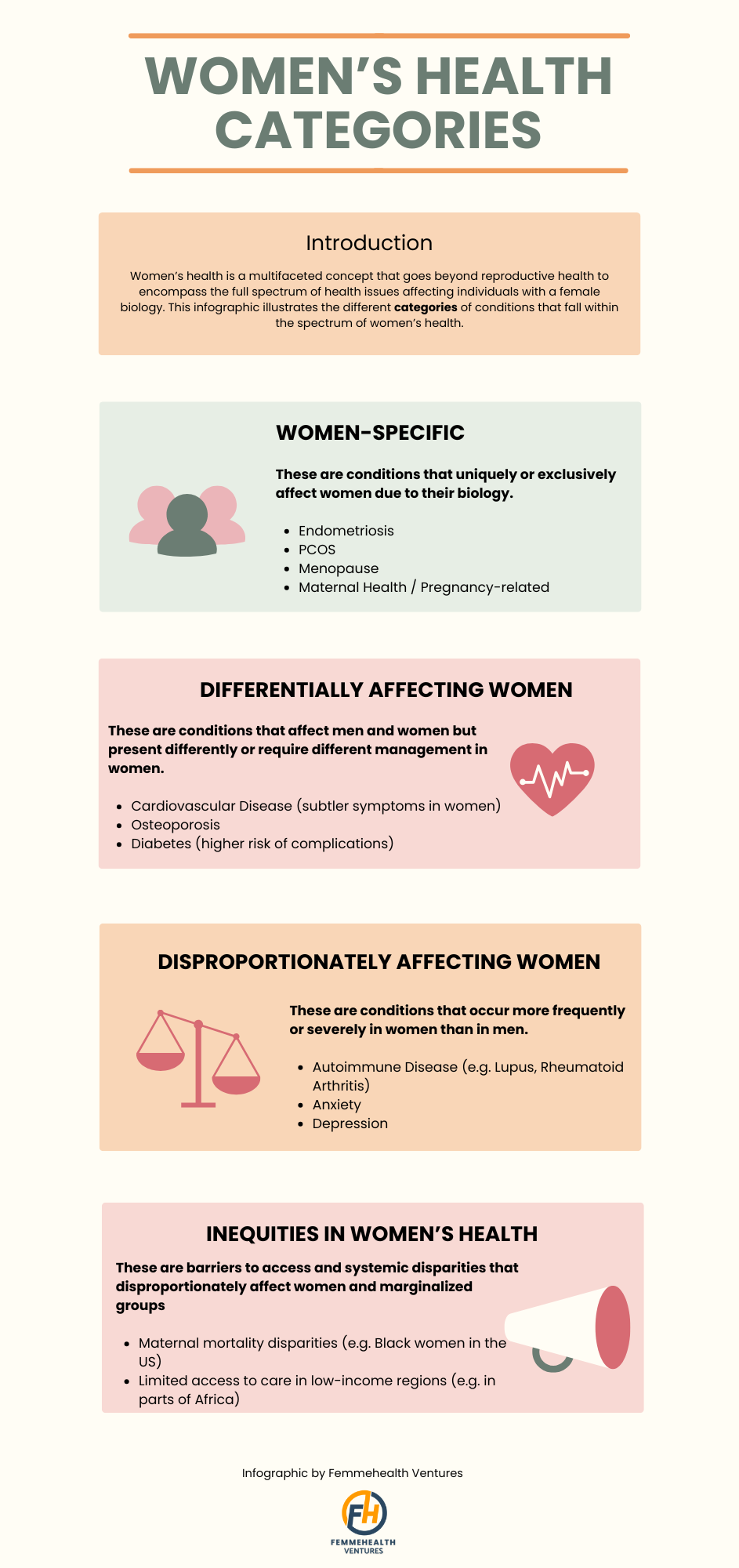

2️⃣ Misconception That Women’s Health = Niche: Investors assume “women’s health” only means reproductive health. In reality, women’s health encompasses more than just sexual and reproductive health. it includes menopause, heart disease, autoimmune conditions, and more.

3️⃣ Market Oversight: Investors follow existing patterns, not necessarily market needs. Aging populations and rising chronic conditions make women’s health one of the most underserved areas in healthcare.

❓Why It Will Keep Happening?

Lack of Visibility: The cycle continues because women’s health companies struggle to raise funding, limiting exits and discouraging new investment.

Under-representation in MedTech & Biotech: Most AI and biotech funding still focuses on general health, meaning solutions tailored for women remain secondary.

Policy & Regulatory Lag: Governments and health bodies move slowly, and without direct incentives, funding disparities persist.

📌What You Can Do About It?

For Investors:

Some see this funding gap as a challenge, while others recognise an opportunity for growth. Women’s health is a $1 trillion market, but funding remains uneven across different sectors. Areas like menopause care, digital diagnostics, and AI-driven solutions are gaining traction. Whether this translates into increased capital flows depends on how market awareness evolves.

For Founders:

The space remains underfunded, but some investors are beginning to focus on key gaps. Companies positioned in areas where demand is growing—such as chronic conditions, reproductive health, and longevity—may find more engagement from funders with a long-term view.

For Advocates and Policymakers:

The conversation is gaining traction, but systemic change requires more visibility, better data, and policy shifts that incentivise R&D investment in women’s health.

💡 Final Thought: The dialogue around women’s health funding is evolving. The key question is whether this momentum will translate into meaningful change.

Ways to Connect with Femmehealth Ventures

Sign-up for Femmehealth Ventures newsletter, which is published weekly on Sundays

Disclaimer

The content in this newsletter is for informational purposes only and does not constitute financial, investment, legal, or medical advice. Opinions expressed are those of the author and may not reflect the views of affiliated organisations. Readers should seek professional advice tailored to their individual circumstances before making decisions. Investing involves risk, including potential loss of principal. Past performance does not guarantee future results.